Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Regardless of how COVID-19 pandemic plays out in the coming weeks and months, italready been brutal for small businesses, with some of them forced close for public safety, while others are taking a big hit in both revenue and access to credit .

So Facebook announced today that itcreating a $100 million grant program for small businesses. Applications aren&t open yet, but the company says this will include both ad credits and cash grants that can be spent on operational costs like paying workers and paying rent. It will be available to up to 30,000 businesses in the the 30-plus countries where Facebook operates.

Facebook has also created a Business Hub with tips and resources for businesses trying to survive during the outbreak..

&We want to do more,& said COO Sheryl Sandberg in a Facebook post. &Teams across our company are working every day to help businesses. We&re looking at additional ways to host virtual trainings & and will have more to share in the coming weeks & and we&re finding more ways to help people connect and learn to use technology through Blueprint, our free e-learning training program.&

In addition, the company announced today that itpartnering with the Lenfest Institute for Journalism and the Local Media Association to offer a total of $1 million in grants for U.S. and Canadian newsrooms that need more resources to properly cover the pandemic. These individual grants will be up for up to $5,000.

- Details

- Category: Technology Today

Read more: Facebook announces $100M grant program for small businesses

Write comment (90 Comments)

Extra Crunch is excited to announce a new community perk from Startup Battlefield alum Osano. Starting today, annual and two-year members of Extra Crunch can receive 60% off their data privacy management software for six months. You must be new to Osano to claim this offer. This coupon is only applicable to Osanoself-service plans. Osano is an easy-to-use data privacy platform that instantly helps your website become compliant with laws such as GDPR and CCPA. Osano works to keep you out of trouble and monitors all of the vendors you share data with — so you don&t have to. Connect the data dots to see whathiding with Osano here.

You can sign up for Extra Crunch and claim this deal here.

Extra Crunch is a membership program from TechCrunch that features weekly investor surveys, how-tos and interviews with experts on company building, analysis of IPOs and late-stage companies, an experience on TechCrunch.com thatfree of banner ads, discounts on TechCrunch events and several Partner Perks like the one mentioned in this article. We&re democratizing information for startups, and we&d love to have you join our community.

Sign up for Extra Crunch here.

New annual and two-year Extra Crunch members will receive details on how to claim the perk in the welcome email. The welcome email is sent after signing up for Extra Crunch.

If you are already an annual or two-year Extra Crunch member, you will receive an email with the offer at some point over the next 24 hours. If you are currently a monthly Extra Crunch subscriber and want to upgrade to annual in order to claim this deal, head over to the &account& section on TechCrunch.com and click the &upgrade& button.

This is one of more than a dozen Partner Perks we&ve launched for annual Extra Crunch members. Other community perks include a 20% discount on TechCrunch events, 90% off an annual DocSend plan and an opportunity to claim $1,000 in AWS credits. For a full list of perks from partners, head here.

If there are other community perks you want to see us add, please let us know by emailing This email address is being protected from spambots. You need JavaScript enabled to view it..

Sign up for an annual Extra Crunch membership today to claim this community perk. You can purchase an annual Extra Crunch membership here.

Disclosure:This offer is provided as a partnership between TechCrunch and Osano, but it is not an endorsement from the TechCrunch editorial team. TechCrunchbusiness operations remain separate to ensure editorial integrity.

- Details

- Category: Technology Today

Read more: Extra Crunch members get 60% off data personal privacy platform Osano

Write comment (99 Comments)With U.S. consumers asked to refrain from social gatherings and shelter-in-place at home due to COVID-19, media consumption is prepared to boom. Based on Nielsen data from prior major crises in recent U.S. history that forced consumers to stay home, total TV usage increased by nearly 60%. We&re not there yet, but consumption is starting to climb in the most impacted markets, the firm found.

For example, Nielsen saw a 22% increase in total TV usage in the Seattle/Tacoma metro last Wednesday, compared with a week ago. New York and L.A. are already seeing usage thatup by 8% during the same time. And for some demographics, usage is much higher.

Seattle teens home from school notched a 104% increase over this period, Nielsen found.

Total TV usage, to be clear, includes watching traditional live TV, DVR recordings, video-on-demand, and streaming services or other content through any TV set, game console or connected device.

But therepotential for TV usage to grow even further.

During a crisis, TV viewing booms as consumers ramp up media consumption to stay informed as well as to kill time.

Nielsen is not officially forecasting the COVID-19 pandemic will increase TV viewing to levels associated with historical crises. But it does note that U.S. consumers have traditionally turned to the TV during troubling times.

When Hurricane Harvey hit Houston in August 2017, for instance, Nielsenanalysis found a 56% increase in total TV usage during the impacted period compared with the preceding period. And during the severe snowstorm that hit New York on the weekend of Jan. 23, 2016, total TV usage was 45% higher during the Saturday of the snow event compared with the Saturday before.

These, of course, were isolated events of a limited during. The COVID-19 crisis is different because it doesn&t just affect one region, nor will it be over within a few days or weeks& time.

During these events, Nielsen said consumers stuck at home were tuning into feature films, news, and general programming.

Streaming, in particular, jumped by 61% during these periods.

The larger impact from COVID-19 could be from the newly remote U.S. workforce. Prior Nielsen data suggests that employees who work remotely Monday through Friday watch over three more hours per week of traditional TV, compared with non-remote workers, at 25 hours and 2 minutes vs. 21 hours and 56 minutes, respectively.

These changes to media consumption related to the COVID-19 crisis come at a time when the U.S. is already at a historical high for media consumption. Before the pandemic, U.S. consumers were already just shy of 12 hours each day with media platforms, and three-fourths of U.S. consumers are broadening their media options with streaming subscriptions and TV-connected devices.

Trends elsewhere in the world indicate COVID-19 will send users to stream even more.

In Italy and Spain, for example, first-time installs of Netflixapp were up 57% and 34%, respectively, according to Sensor Tower data.

In addition, live streaming across YouTube, Twitch, Facebook, and Mixer grew by over 66% in Italy between the first week of February and this past week, according to StreamElements, and viewers were watching nearly double the number of channels.

But brands looking to capitalize on the stuck-and-home audience may not find that their messages resonate or produce the actions they desire. Thatbecause brands are looking to increase sales for products and services, and many consumers won&t now risking leaving their home to spend.

- Details

- Category: Technology Today

Read more: Nielsen explains how COVID-19 could impact media usage across the U.S.

Write comment (100 Comments)

Japanese telecom conglomerate SoftBank Group has faced a litany of bad news in recent weeks, including reported revelations from the Wall Street Journal that the head of its Vision Fund was using corporate espionage firms to sabotage his corporate peers and that activist hedge fund investor Elliott Management had invested in the company to try to force more transparency to its balance sheet and board of directors in a bid to drive its stock price higher.

The bad news just keeps coming though.

Today, S-P Global Ratings downgraded the groupdebt outlook to &Negative& from &Stable& while affirming the debtrating of BB+, which is generally considered somewhat speculative or non-investment grade.

In the note from the ratings agency, S-P said that it was particularly concerned about SoftBankshare repurchase program, which would see cash liquidity decrease as it buys up shares from investors on the public markets. That program, which would encompass about $4.8 billion in share buybacks and was announced last week, &[raises] questions over its intention to adhere to financial management that prioritizes its financial soundness and the credit ratings on it.&

My colleague Arman and I have covered SoftBankdebt obsession obsessively on TechCrunch, but we last conducted that analysis at the tail end of 2018 when markets were still soaring and SARS-CoV-2 had yet to be discovered.

Now though, SoftBankpenchant for debt is running straight into one of the most harrowing moments in recent economic history.

SoftBankdebt-fueled expansion is particularly notable in its Sprint and T-Mobile telecom merger, which was recently approved by U.S. antitrust authorities and included tens of billions of dollars of debt to consummate, as well as in the Vision Fund, where special provisions in the fundstructure guarantees a minimal level of return to investors. As the Financial Times reported back in 2017:

That debt provided by the Vision Fundinvestors will be in the form of preferred units, which will receive to an annual coupon of 7 per cent over the fund12-year life cycle.

Yet, with few IPOs likely on the horizon given the catastrophic fall in the markets the past few days, what will happen to liquidity in the Vision Fund, and how will it meet that 7% minimum target? Or how will the combined Sprint and T-Mobile win over customers in a quickly souring economy to pay off down its gargantuan debt load?

The upshot for SoftBank is that it offers a service most customers consider essential. Thatone of the reasons why its debt hasn&t seen a ratings downgrade: ultimately, consumers are still going to need their smartphones to work. But with the piles of debt adding up and the economy in tatters, its future is looking evermore hazy and dangerous.

- Details

- Category: Technology Today

Read more: SoftBank’s debt outlook turns negative

Write comment (94 Comments)

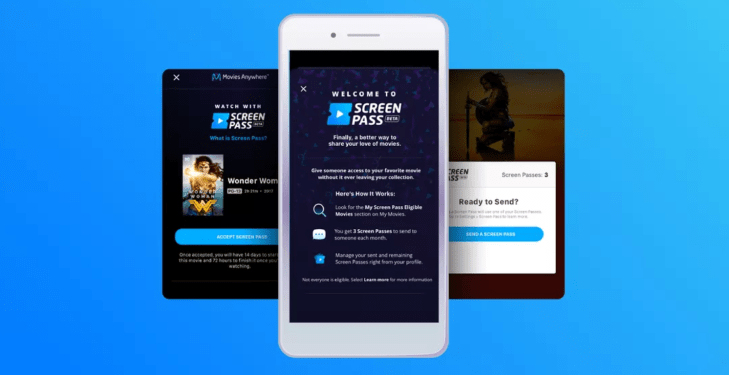

Movies Anywhere, the digital locker service that lets you access your purchased movies from across services including iTunes, Vudu, Prime Video, YouTube, Xfinity, and others, is preparing to launch a new movie sharing option. According to a report from CNET, the service today will begin testing a new &Screen Pass& feature that allows users to share a movie with friends via a text message sent from the Movies Anywhere mobile app.

Users must accept the Screen Pass within 7 days to gain access to the shared title.

The new feature will work a lot like a movie rental, as recipients have a limited time to watch the movie — in this case up to 14 days. Viewers then have 72 hours to finish watching the shared movie.

Meanwhile, Movies Anywhere users will also be limited to sharing only three movies per month.

The movies can be watched across the Movies Anywhere platform, except on Roku devices for the time being.

The feature isn&t yet publicly available, but is instead launching into a limited beta test later today, CNET says. The plan was to have Screen Pass commercially available by late summer or early fall. In other words, it may not be around to help consumers stuck at home looking for something to watch during the early days of the COVID-19 crisis.

A spokesperson told the news outlet they&re working to move up the launch, in light of the &unprecedented& circumstances facing the U.S.

The Movies Anywhere app, originally called Disney Movies Anywhere, has been around in some form since 2014 but remains a bit under-the-radar as people now turn to streaming services to watch their favorite films Initially intended as a way for Disney fans to aggregate their Disney, Pixar, and Marvel film purchases in one place, long before Disney+ was even conceived, todayMovies Anywhere service is jointly operated by a number of industry partners. In addition to Disney, this includes Universal, WB, Sony Pictures, and 20th Century Fox.

Itnot clear at this time how many movies will be enabled for Screen Pass when it goes live, but it will be limited to select titles, the report noted.

- Details

- Category: Technology Today

Read more: Movies Anywhere to launch a movie-sharing feature called ‘Screen Pass’

Write comment (96 Comments)

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

As investors struggle to price the stock market as economic and political news continues to break, the private market is entering a rough period. It seems increasingly likely that the period of disruption due to COVID-19 will persist for months, if not quarters. That means missed Q1 and Q2 revenue growth, bookings, and the like from startups domestically and around the world.

And thatthe bullish case. For some cohorts of startups, the outlook is even worse. Think about travel startups, ride-hailing upstarts, and any grouping of private companies that pursued a high-burn, high-growth model; that final category is about to run into the twin issues of the inflexibility of cost structure and the impact of slowing sales. That alone would make fundraising more difficult; toss in a deflating stock market and possible recession, and the mixture is a downright mess.

But we owe it to ourselves to survey what is going on in an attempt to answer our own questions about IPOs, exits, unicorn tallies, and who might be in trouble. Unlike when things were less bad, there will be no laughing this morning and no jokes. Just notes on whatgoing wrong and what it might mean for private companies.

- Details

- Category: Technology Today

Read more: Have numerous unicorns missed their exit window as Q1 IPOs grind to a stop

Write comment (94 Comments)Page 1223 of 1445

14

14