Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

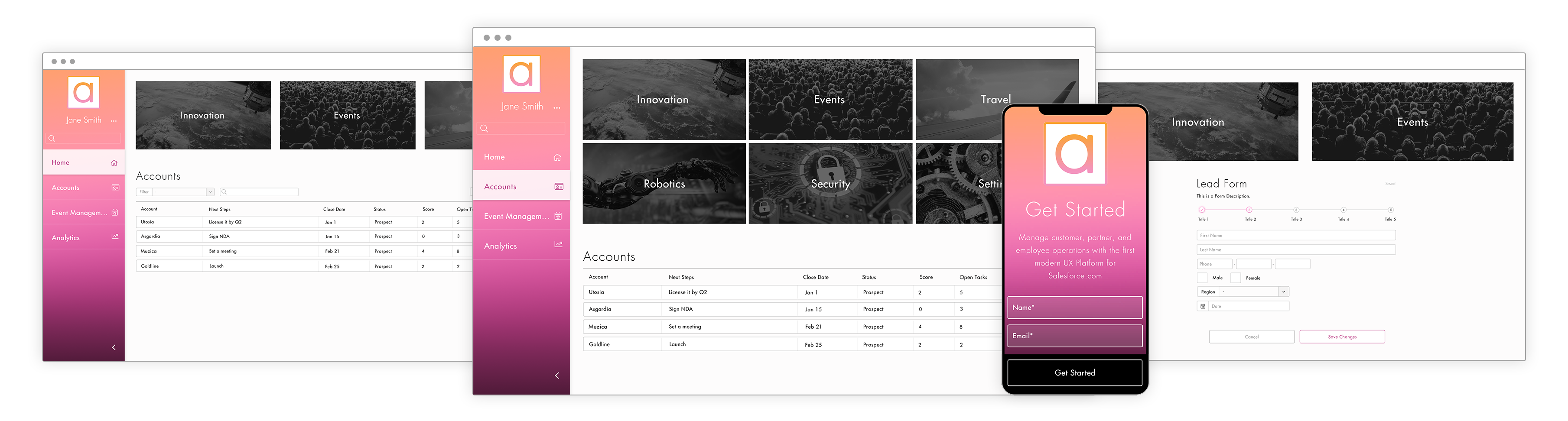

Addapptation, a startup that wants to build a practical design layer on top of Salesforce and other enterprise tools, announced a $1.3 million seed investment today.

2048 Ventures led the round with participation from East Coast Angels, The Millworks II Fund and additional angel investors from New Hampshire, where the firm is located

Co-founder Sumner Vanderhoof says the startupgoal is to build a user experience platform for enterprise tools like Salesforce . &Our goal is to help make simple, easy to use Salesforce.com solutions built on the addapptation UX platform.

&At the end of the day, we&re really helping transform the way companies work, making their employees more efficient, making the job they do easier and more consistent, so they have a bigger impact on the companies that they work for,& Vanderhoof told TechCrunch.

He says they do this by looking at the company workflow and what issue the customer is trying to solve — such as a problem converting deals through the sales cycle. They will then help build tools and an interface to make it easier to pinpoint this information with the goal of being able to reuse whatever solutions they create for other customers.

He says the platform is template-driven and designed to quickly go from idea to solution. A typical solution takes no longer than two weeks to build and implement. Once a customer is using addapptation, employees can log into the addapptation platform or it can be a layer built into Salesforce providing a more guided experience.

The company has built around 40 plug-ins for the platform, including a heat map that identifies where sales is likely to find the best opportunities to close a deal. The solutions they build are designed to work online or on mobile devices as needed.

Photo: addapptation

Vanderhoof says that the company has a good relationship with Salesforce, and it doesn&t compete directly with the company. &Their main focus is providing tools for a wide audience. Ours is extending the platform beyond what it can do,& he said.

The two founders, Vanderhoof and his wife Carla, took three years building the platform, essentially bootstrapping before taking todayfunding. The company has 15 employees in its Exeter, NH, headquarters and has 20 customers including Comcast and Ingram Micro.

- Details

- Category: Technology Today

Read more: Addapptation snares $1.3M seed to build a better UX for Salesforce

Write comment (90 Comments)

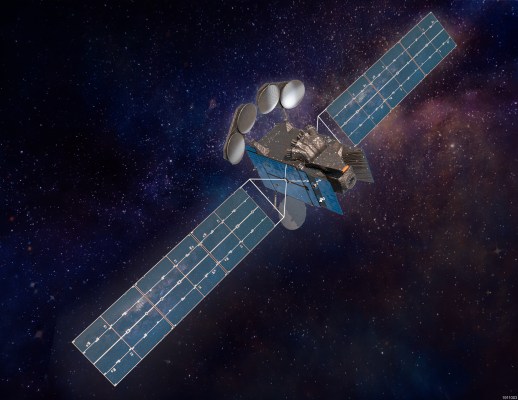

Intelsat has tapped SpaceX for the launch of its Intelsat 40e spacecraft, a high-throughput communications satellite that will join the companyexisting geostationary network. The satellite is being built by Maxar, Intelsat announced last month, and will be carried to its target orbit by a Falcon 9 rocket using a flight-proven first-stage booster.

Intelsat is a connectivity infrastructure company that operates a communications network providing video and broadband services globally. The Intelsat 40e satellite will specifically help serve customers in North and Central America.

SpaceX has provided launch services for Intelsat previously, flying its 35e satellite to orbit in 2017. That satellite is currently in operation, offering connectivity to customers across North and South America, as well as in Europe and Africa.

This next launch is set to take place in 2022, so not immediately, but itan important get and a valuable return client for SpaceX.

- Details

- Category: Technology Today

Read more: SpaceX will launch Intelsat’s next satellite using a re-used Falcon 9 in 2022

Write comment (93 Comments)The era of social distancing is going to put a lot of existing systems to the test. Nintendoonline services for the Switch have been experiencing outages in the U.S. and parts of Europe. The company noted the issues on social media, adding that it&looking to rectify the situation as soon as possible.&

The official Network Maintenance Information page noted that it is currently &Unable to connect to the network service.&

Surely not the most dire of situations, though many are no doubt relying on such services to help pass the time, as more and more cities enact bans on gatherings and closures of schools and restaurants to encourage social distance in order to curb COVID-19spread. MicrosoftXbox Live also experienced a multiple-hour outage over the weekend.

Nintendo is currently readying the system for the release of Animal Crossing: New Horizons. The latest entry in the series looks perfectly positioned to help eat away some hours when itreleased March 20.

- Details

- Category: Technology Today

Read more: Nintendo’s online Switch services are experiencing an outage when we need them most

Write comment (100 Comments)Good morning friends, and welcome back toTechCrunchEquity Monday, a short-form audio hit to kickstart your week. Regular Equity episodes still drop Friday morning, so if you&ve listened to the show over the years, don&t worry — we&re not changing the main show.

For folks hunting for our longer-form work, herelast weekepisodewithDanny Crichton and Natasha Mascarenhas, and hereyesterdayinterview with YC boss Michael Seibel.

Equity Monday is a day late this week as I was off yesterday, but ithere today and what a mess the world is at the moment. That was a key theme of the show, but not the only thing that we mentioned. Here are some other bits of news that caught our eye:

- GoJek raised $1.2 billion more, a stunning round for this time in the venture cycle.

- HashiCorp raised $175 million at a valuation of more than $5 billion, a huge round at an enormous price in any era, but even more so in todaymarket.

- AI startups are being snapped up at record rates, with a record-setting 231 deals in 2019. According to the same data set, the Big Five were buying the most AI startups, along with Intel.

Looking ahead therelittle to anticipate aside from Tencent earnings. So, instead, meet Hourly, a neat company that just raised $7.2 million.

Hourly

Hourly provides a software solution for labor tracking and payroll processing, noting industries like construction, service and light industry on its website. If a company has a workforce that gets paid by the hour (the companyname is a tip-off), Hourly wants to help them keep tabs on the labor, and help them pay for it.

The startup charges for its tooling on a recurring basis, a regular setup for a modern software product delivered as a service. After paying some modest base prices, time tracking costs $8 per employee per month, while its payroll service costs a bit more at $10 per employee per month. According to Hourly CEO Tom Sagi, the company may bundle the two services in the future and offer a discount of perhaps 20% for companies that buy both.

Time tracking and payroll, however, aren&t the only ways that Hourly generates revenue.

Growth

Hourly also drives top line through its workers& compensation insurance product, which it refers to as &powered by& itself and &backed by A-rated carriers.& According to Sagi, the company currently generates about half its revenue from workers comp commissions.

That means that Hourly has a two-part SaaS business and a technology-powered insurance business. (Sagi detailed to TechCrunch the ins and outs of worker comp payments, employee classification and more; itreasonably complex, perhaps providing the startup with a moat of sorts.) If that sounds pretty impressive for a company that just put together $7.2 million, it is — at least compared to how much other startups seem to get done before a round of that size.

How did Hourly get so far with so little money? The firm bootstrapped, hiring engineers in Colombia — the firm now has 10 staffers in that country, but is headquartered out of Palo Alto — to reduce costs. Keeping its costs low let Hourly avoid outside capital — aside from things like family funding and credit cards — before today. And that means that for its external capital base, the company feels somewhat product-mature.

That maturity is letting it bring on larger clients. According to Sagi, Hourly has been increasingly &appealing to larger companies,& which he clarified to mean firms with 20 people or more. Larger customers means larger contract values, which can mean faster growth.

What else?

Oh just the closing of the unicorn exit window for some time. Aside from distressed sales, what sort of company would want to exit in a time like this? More from the Equity crew soon, hang tight.

Equity drops every Friday at 6:00 am PT, so subscribe to us onApple Podcasts,Overcast,Spotifyand all the casts.

- Details

- Category: Technology Today

Read more: Equity Tuesday: Wild markets, a neat early-stage round and the closed IPO window

Write comment (99 Comments)Investors seem to be taking a wait-and-see approach to the markets right now, after a bumpy evening where a presidential tweet and commitment of economic support seemingly sent traders to smash buy buttons before realizing that there was no new substance behind Mondaynight moves.

Economies around the world are in for a rough ride as businesses shut down and social distancing measures take effect to limit the spread of the novel coronavirus, which is already a global pandemic and an epidemic in the U.S.

After their worst day of trading since 1987, stocks rose sharply in overnight trading. The pattern of shares falling sharply, followed by a rebound of sorts, continues, then, as traders continue to look for signals amidst the global noise; how to value one promise of further government stimulus, for example, against more border shutdowns and bad corporate news is now daily labor.

But as stocks opened domestically, they did manage slight gains, a welcome sight after yesterdaysharply negative trading. Herethe morning report at the open:

- Dow Jones Industrial Average: rose 314.81 to 20,503.33 for a gain of 1.56%

- S-P 500: rose 52.91 to 2,439.04 for a gain of 2.22%

- Nasdaq Composite: rose 147.45 to 7,052.05+147.45 for a gain of 2.14%

Even cryptocurrencies are seeing a bit of a comeback, though they, like stocks, remain depressed when compared to recent highs. Bitcoin, the most famous of all cryptos (as the distributed tokens are sometimes called), is off by about half.

The latest economic forecasts are bleak. Goldman Sachs expects a Q1 contraction of perhaps 5%, a shocking figure. Even more, per reporting, the bank sees it likely that the U.S. will enter a recession. If you were waiting for the correction, this is it. We have now seen the end of the long-running bull cycle that brought companies like Dropbox and Airbnb and Slack and Zoom from little-to-nothing to giant-status. This is the downturn. A new generation of startups will soon be born that will lead the markets higher in the future. But, given the economic data we&re seeing, not yet.

The TechCrunch crew will keep tracking the public markets so long as they are fascinating. More on how select companies performed when the day closes.

- Details

- Category: Technology Today

Last week, I talked with Mike Volpi, longtime Index Ventures partner and the former head of M-A at Cisco for many years before that. We originally planned to talk about Index and general market trends, and we did. The topics we discussed included whether self-driving technologies have attracted too much funding and the damage inflicted by SoftBank on its portfolio companies.

Still, few could have predicted how extraordinarily trying the week would be leading up to our interview. Little wonder we spent much of our time talking about who is likely to snap shut their checkbook first, and why, in some cases, the best thing to do now is to keep the money flowing.

We have parts of our conversation available in podcast form here; other pieces, including those not included in the podcast, follow. These excerpts have been lightly edited for length.

TechCrunch: Lettalk first about Index. You closed your last funds in 2018 with $1.65 billion in capital commitments. Are you in the market again now?

Mike Volpi: We raise funds every three-ish years. So, at some point, yeah, we&ll be in the market again. [We are] not specifically at this point in time, but sooner or later we&ll raise another fund.

More broadly speaking — and because the market is tanking so badly as we speak — do LPs tend to snap their checkbooks shut as soon as trouble hits? Whatbeen your experience over the years?

- Details

- Category: Technology Today

Read more: Veteran VC Mike Volpi discusses investing and fundraising in ‘a very difficult time’

Write comment (100 Comments)Page 1225 of 1445

5

5