Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Last week, Google sent out a memo to staff recommending that Washington State-based employees work remotely, in order to mitigate the potential spread of COVID-19. Today, the suggestion has been dramatically expanded, in line with the spread of the virus. A new note from the company recommends similar action for employees across North America.

A spokesperson for the company confirmed earlier reports with TechCrunch that employees across the continent are being recommended to work from home, if their positions allow for it. The company confirmed that other regions have been given similar guidance, as well. Europe, for example, is mostly recommended to work from home at present. Different regions are subject to different guidance, based on a variety of local requirements.

Last weekprecautions followed initial reports of the coronavirus strainspread in the Pacific Northwest, including King County, in which Googlelargest offices in the state — Seattle and Kirkland — are based. Instances of COVID-19 have spread quickly across the country. At last count, the Centers for Disease Control and Prevention has cases listed at 647 nationally, with 25 deaths. New York State has jumped to the top spot, with more than 170 cases reported.

Google is one of a rapidly growing list of tech companies taking similar action to avoid the spread of the virus. Microsoft, Box, Lyft and others have addressed concerns with employees, either recommending or requiring staff to work from home, and, in some cases, maintaining wages in spite of reduced hours. Googleannual spring time developer conference I/O was among the major tech shows that are taking the year off over health precautions.

The software giant has also announced the establishment of a COVID-19 fund for temporary staff and vendors across the world.

&As we&re in a transition period in the U.S.—and to cover any gaps elsewhere in the world—Google is establishing a COVID-19 fund that will enable all our temporary staff and vendors, globally, to take paid sick leave if they have potential symptoms of COVID-19, or can&t come into work because they&re quarantined,& GoogleDirector, Workplace Services Adrienne Crowther writes. &Working with our partners, this fund will mean that members of our extended workforce will be compensated for their normal working hours if they can&t come into work for these reasons. We are carefully monitoring the situation and will continue to assess any adjustments needed over the coming months.&

- Details

- Category: Technology Today

Organizers of the 2020 New York International Auto Show have postponed the event until August due to concerns about the COVID-19 outbreak.

The New York Auto Show, which is organized by the Greater New York Automobile Dealers Association, was scheduled to begin April 10 at the Jacob K. Javits Convention Center in New York City.

The event will now be held August 28 to September 6, according to a statement from Chris Sams, the showspokesman. Press days are August 26 and 27.

&We are taking this extraordinary step to help protect our attendees, exhibitors and all participants from the coronavirus,& Mark Schienberg, president of the Greater New York Automobile Dealers Association, said in an emailed statement.&For 120 years, ‘the show must go on& has been heavily embedded in our DNA, and while the decision to move the show dates didn&t come easy, our top priority remains with the health and well-being of all those involved in this historic event. We have already been in communication with many of our exhibitors and partners and are confident that the new dates for the 2020 Show will make for another successful event,& Schienberg added.

A number of automakers had planned to debut their vehicles at the show, including electric vehicle startup Lucid Motors, as well as large OEMs like Ford and GM.

The New York Auto Show joins a growing list of events that have been cancelled or delayed due to concerns about COVID-19, a disease caused by a new virus that is a member of the coronavirus family. COVID-19, which is a close cousin to the SARS and MERS viruses that have caused outbreaks in the past, has caused governments and companies to cancel tech, business and automotive events around the world.

Just yesterday, Cadillac announced plans to cancel the unveiling of its new electric vehicle at a special event next month in Los Angeles. The Geneva International Motor Show was cancelled, as well as MWC in Barcelona and the SXSW festival in Austin, Texas.

- Details

- Category: Technology Today

Read more: New York Auto Show delayed until August over coronavirus concerns

Write comment (95 Comments)

Sometimes, it takes only the promise of a massive government bailout to put that rose-colored filter on the effluent sandwich of todayeconomic realities.

After yesterdayterrifying sell-off, American equities recovered today, with the major domestic indices rising to close the day. While the daygains do not erase yesterdaylosses, they are a welcome return to form for equity markets long-accustomed to rising.

The final results in less turbulent times would be more shocking, but today the Dow Jones Industrial Average rose 1,167.1 points, or 4.89%, the S-P 500 rose 135.7 points, or 4.94%, while the Nasdaq Composite picked up 393.6 points, or 4.95%.

SaaS and cloud stocks, however, lagged their broader sector, only managing a 3.1% gain, according to the Bessemer-Nasdaq cloud index. This means that after SaaS and cloud stocks lost more yesterday (in percentage terms), they also recovered less than their peers. After a long period of leading, modern software companies are being repriced in the public markets, possibly leaving the company category with less of a premium over other tech companies.

The rally was broad, with bitcoin ending a period of decline, and oil sharply ascending.

Still, the public markets are down from their heights. The Dow is off 15%, and touched a new 52-week low today before recovering. The S-P is also off a smidgen over 15%, while the Nasdaq is down a hair more at 15.2%, compared to its recently set 52-week highs.

A few more days like today are needed, then, to fully repair the damage. And therestill the overhang of bad news, including: a quarantine zone set up in New Rochelle, N.Y.; the terrible shape of oil and gas companies& debt loads; and the lack of any clarity around an actual bailout from the government.

Hopefully tomorrow morning stocks are quiet, and then the TechCrunch Public Markets Crew (Shiebs and Alex) can stop writing these posts. Until then, however, expect more.

As a final note, Apple and Microsoft are still trillion-dollar companies. So even in the throes of this correction, tech is hardly in the dumps. And the Nasdaq is up 12.6% over the last year.

- Details

- Category: Technology Today

Read more: Turbulent trading leads to market gains as stocks recover, SaaS lags

Write comment (99 Comments)Startups have welcomed proposals from the European Commission aimed at cutting red tape and shrinking cross-border barriers for small businesses as part of a new EU industrial strategy plan with a twin focus on digital and green transitions unveiled today.

Among the package of measures being proposed by the European Unionexecutive body are for Member States to sign up to a &Startup Nations Standard& — which would aim to promote best practices to support startups and scale-ups, such as one-stop shops, favourable employee stock-options arrangements and visa processing to reduce cross-border friction for entrepreneurs starting and growing businesses in the bloc.

In recent years, European startups have organized to campaign for reforms to rules around stock options &with 30 CEOs from homegrown startups, including TransferWise, GetYourGuide, Revolut, Delivery Hero, TypeForm and Supercell (to name a few) signing an open letter to policymakers two years ago calling for legislators to fix what they dubbed &the patchy, inconsistent and often punitive rules that govern employee ownership.&

The effort appears to have made a dent in the EU policymaking universe. Both regulatory and practical barriers are now in the Commissionsights, with it proposing a joint task force to work on sanding down business bumps.

It also today reiterated a perennial warning against Member States &goldplating& pan-EU rules by adding their own conditions on top.

&The Single Market is our proudest achievement — yet 70% of businesses report that they do not find it is sufficiently integrated,& said EVP Margrethe Vestager, laying out an industrial strategy package with a big focus on smaller companies, including those with big ambitions to scale. &Across Europe barriers are still preventing startups from growing into European businesses and our report is identifying those barriers and we also then address them in the Single Market enforcement action plan.&

In a letter responding to the Commissionplan for an EU Startup Nations Standard, 14 European startup founders (listed below) and a number of European startup associations welcomed the proposal — urging EU Member States to get behind it.

&By making it easier to start a business, expand across borders and attract top talent, this new Standard will help to level the playing field with powerful global tech hubs in the US and China,& the tech CEOs and startup advocacy organizations wrote. &We applaud the EUambition of seeking a pan-European solution to address the needs of startups. We are also encouraged that the Commission has specifically called out the treatment of stock options as one of the key issues.

&As highlighted by more than 500 leading European entrepreneurs who joined the Not Optional campaign, the inability of startups to use stock options effectively to attract and retain talent is a major bottleneck to the growth of startups in Europe.&

&The Commissionproposals will be a major step towards unleashing the full entrepreneurial firepower of Europe & but only if they are adopted and implemented by all Member States,& they added. &Thatwhy we are today calling on all Member States to sign up to the EU Startup Nations Standard, including a commitment to increase the attractiveness of employee ownership schemes.&

Herethe list of startup CEOs signing the letter:

- Christian Reber, CEO - Founder, Pitch

- Felix Van de Maele, CEO - Founder, Collibra

- Jean-Charles Samuelian, CEO - Founder, Alan

- Johannes Reck, CEO - Co-Founder of GetYourGuide

- Johannes Schildt, CEO - Founder, KRY / LIVI

- John Collison, Co-Founder and President, Stripe

- Juan de Antonio, CEO - Co-Founder, Cabify

- Markus Villig, CEO - Founder, Bolt

- Miki Kuusi, CEO - Co-Founder, Wolt

- Nicolas Brusson, CEO - Co-Founder, BlaBlaCar

- Peter Mühlmann, CEO - Founder, Trustpilot

- Sebastian Siemiatkowski, CEO - Founder, Klarna

- Taavet Hinrikus, Founder - Chairman, TransferWise

- Tamaz Georgadze, CEO - Founder, Raisin

Also welcoming the stock option proposals, Martin Mignot, a partner at Index Ventures — another backer of the Not Optional campaign — said: &The biggest challenge facing startups today is recruiting and retaining top talent. Thatwhy we are pleased that the EU Startup Nations Standard addresses stock options, making it easier for startups to allow employees to share in their success.&

&We are pleased to see the European Commission recognise the contribution that startups make to Europe and its citizens, and pursue a pan-European policy initiative to support this growing sector,& he added in a statement. &For too long, the focus in Europe has been on taming US tech giants. Todayannouncement confirms Europeambition to create its own champions.&

EU startup advocacy member association, Allied for Startups, is another signatory to the letter. And in an additional response, it broadly welcomed the CommissionSME strategy — while pressing for a strong focus on startups as independent actors in the implementation of the strategy, rather than as a sub-category of SMEs.

&The talent-focus of the proposed Startup Nation Standard has significant potential for startup ecosystems, since access to talent is still a bottleneck for startups in Europe,& said Benedikt Blomeyer, the lobby groupdirector of EU policy, in a statement.

&Through the SME strategy, we are pleased to see concrete measures such as better startup visas and improved employee stock options on the table. Allied for Startups has repeatedly called for both measures over the past years.&

&Unlike SMEs, startups can only succeed at scale,& he added. &They are global from day one and aim to grow big and fast. Specific measures that work for SMES, for instance a regulatory exemption, might not work for startups. On the contrary, it could incentivise a startup to stay small. To account for these differences, the European Commission should consider a startup strategy that focuses on scalability, complementing the SME strategy.&

Allied for Startups also welcomed the Commissiongeneral goal of reducing the administrative and regulatory burden for startups within the Single Market — saying the consideration of regulatory sandboxes as part of the support toolkit is &potentially valuable for startups, who build innovative products and services.&

The Commission is also looking to support SMEs to go public in Europe — announcing an SME Initial Public Offerings (IPOs) Fund under the InvestEU SME window, which will aim to make IPOs more accessible to local small businesses.

Another push aims to reduce late payments for SMEs, with the Commission noting today that one in four regional small businesses go bankrupt as a result of not being paid on time.

It also said it wants to stimulate investment in women-led companies and funds to &empower female entrepreneurship.& (Notably all the signatories on the aforementioned letter are male.)

Industrial to digital transformation

More broadly, the Commissionnew industrial strategy intends to underpin core EU policy priorities for the next five years — which include a focus on driving the digitization of legacy industries and simultaneous retooling to transition to a carbon neutral economy under the pan-EU Green Deal.

&Europe has the strongest industry in the world. Our companies — big and small — provide us with jobs, prosperity and strategic autonomy. Managing the green and digital transitions and avoiding external dependencies in a new geopolitical context requires radical change — and it needs to start now,& said Thierry Breton, commissioner for internal market, in a statement today.

During a press briefing, Vestager emphasized the Commissionview that new and more inclusive working methods are needed to deliver on the planned transformation.

&The twin digital and green transitions are posing both opportunities and challenges for the industry in general and for small and medium sized businesses in particular. Business models are changing. All across Europe companies are confronted with consumers& decreasing trust and increasing demand for transparency,& she said. &The world around us is also changing… Today global competition, trade disputes, the return of protectionism — I think that creates a shared feeling of uncertainty.

&This is challenging Europeindustry as it sets out to meet the twin transitions. Fortunately, the European industry is coming to this reality from a strong position. Our new strategy is building on Europestrength and on our values.&

On the proposals to shift to &inclusive& working methods, Vestager said the aim is &to work much closer with small and large companies, Member States, researchers, academia, social partners and other EU institutions.&

To that end, the Commission is proposing a new industrial forum to enable closer working with such stakeholders that it aims to have set up by September.

It also wants to work on identifying a number of industrial ecosystems — which Vestager said &may require a bespoke approach,& in terms of policy support.

At the press briefing, Breton suggested there could be between 15 and 20 such industrial ecosystems.

&We don&t want to leave anybody out,& he said. &This is an industrial strategy but we all know that underpinning this there are large corporations but many, many, many small ones too and we have to bring these on board. If we don&t have the big and the small we won&t have a dynamic, innovative, living sector.

&A lot of companies do this among themselves already, locally in fact, but we do hope it is going to be done in an even more horizontal manner across the EU and within the internal market,& he added.

Skills is another focus for the SME strategy — with the Commission saying it will expand Digital Innovation Hubs to every region in Europe to help small businesses plug in cutting edge tech, with expanded options for volunteering and training on digital technologies.

Helping SMEs find the skills they need to shift to sustainable ways of working is another stated aim.

The Commission has published a Q-A on the industrial strategy here.

Last month the executive body also set out proposals aimed at encouraging industrial data sharing and reuse, along with proposals for regulating high-risk uses of artificial intelligence.

A further major piece of EU digital policy due later this year is the forthcoming Digital Services Act — which is slated to address platform liabilities and responsibilities, including toward smaller businesses that rely on them as a marketplace.

- Details

- Category: Technology Today

Read more: European startups applaud Commission plan to rethink stock options

Write comment (93 Comments)I see far more research articles than I could possibly write up. This column collects the most interesting of those papers and advances, along with notes on why they may prove important in the world of tech and startups.

This week: crowdsourcing in space, vision on a chip, robots underground and under the skin and other developments.

The eye is the brain

Computer vision is a challenging problem, but the perennial insult added to this difficulty is the fact that humans process visual information as well as we do. Part of that is because in computers, the &eye& — a photosensitive sensor — merely collects information and relays it to a &brain& or processing unit. In the human visual system, the eye itself does rudimentary processing before images are even sent to the brain, and when they do arrive, the task of breaking them down is split apart and parallelized in an amazingly effective manner.

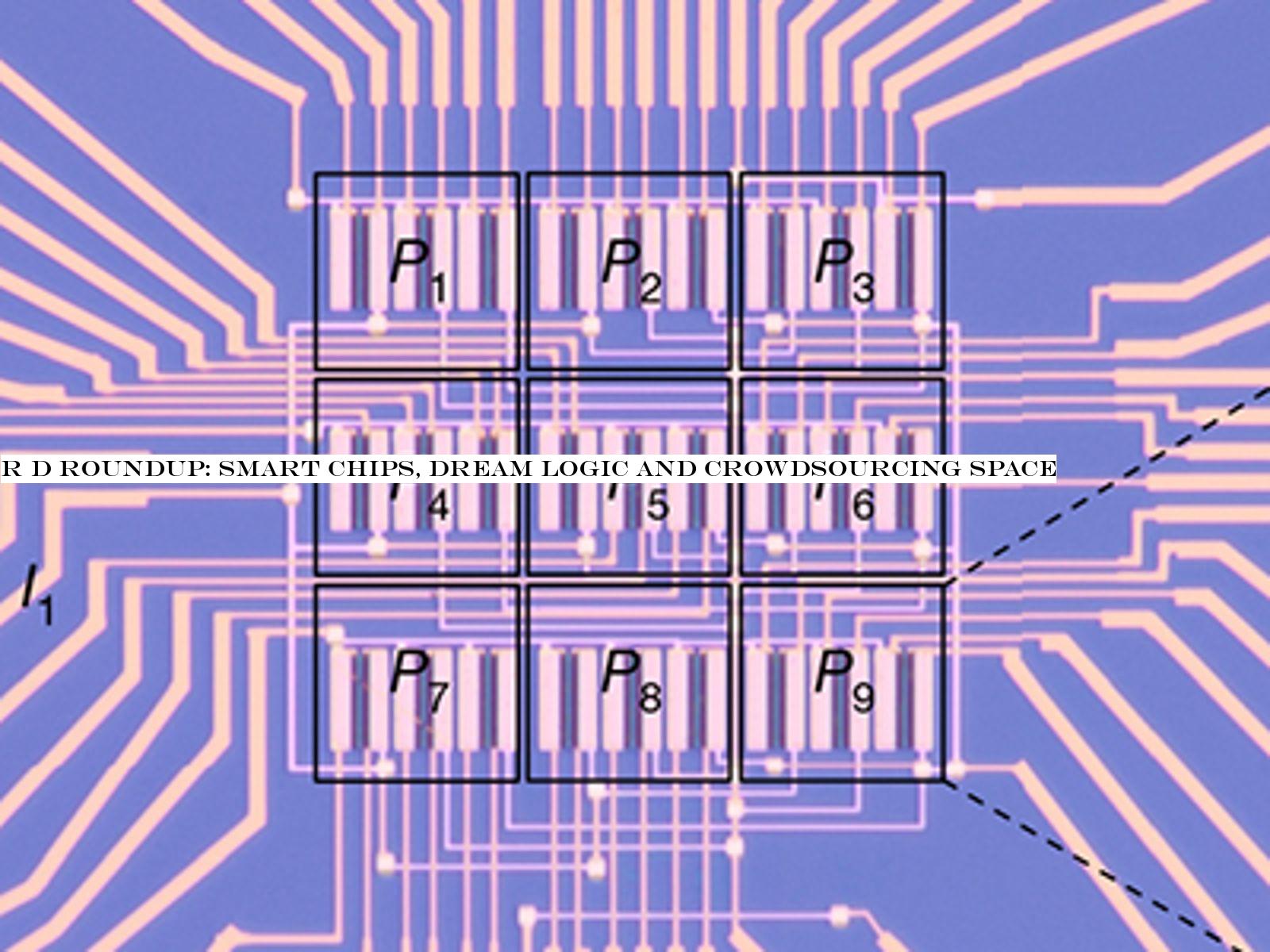

The chip, divided into several sub-areas, which specialize in detecting different shapes

Researchers at the Vienna University of Technology (TU Wien) integrate neural network logic directly into the sensor, grouping pixels and subpixels into tiny pattern recognition engines by individually tuning their sensitivity and carefully analyzing their output. In one demonstration described in Nature, the sensor was set up so that images of simplified letters falling on it would be recognized in nanoseconds because of their distinctive voltage response. Thatway, way faster than sending it off to a distant chip for analysis.

- Details

- Category: Technology Today

Read more: R D Roundup: Smart chips, dream logic and crowdsourcing space

Write comment (98 Comments)

Dell 2015 decision to buy EMC for $67 billion remains the largest pure tech deal in history, but a transaction of such magnitude created a mountain of debt for the Texas-based company and its primary backer, Silver Lake.

Dell would eventually take on close to $50 billion in debt. Years later, where are they in terms of paying that back, and has the deal paid for itself?

When EMC put itself up for sale, it was under pressure from activist investors Elliott Management to break up the company. In particular, Elliott reportedly wanted the company to sell one of its most valuable parts, VMware, which it believed would help boost EMCshare price. (Elliott is currently turning the screws on Twitter and SoftBank.)

Whatever the reason, once the company went up for sale, Dell and private equity firm Silver Lake came ‘a callin with an offer EMC CEO Joe Tucci couldn&t refuse. The arrangement represented great returns for his shareholders, and Tucci got to exit on his terms, telling Elliott to take a hike (even if it was Elliott that got the ball rolling in the first place).

Dell eventually took itself public again in late 2018, probably to help raise some of the money it needed to pay off its debts. We are more than three years past the point where the Dell-EMC deal closed, so we decided to take a look back and see if Dell was wise to take on such debt or not.

What it got with EMC

- Details

- Category: Technology Today

Read more: Dell spent $67B buying EMC — more than 3 years later, was it worth the debt

Write comment (98 Comments)Page 1277 of 1444

20

20