Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

- Details

- Category: Technology Today

Read more: How to automate repetitive tasks in Slack

Write comment (97 Comments)It wasn&t the leap year, a coding blip, or a hack that caused Robinhood massive outages yesterday and today that left customers unable to trade stocks. Instead, the co-CEOs

write that &the cause of the outage was stress on our infrastructure — which struggled with unprecedented load. That in turn led to a &thundering herd& effect — triggering a failure of our DNS system.&

Robinhood was offline from Monday at 6:30am Pacific to 11pm Pacific, then had another outage this morning from 6:30am Pacific until just before 9am Pacific.

The $912 million-funded fintech giant will provide compensation to all customers of its Robinhood Gold premium subscription for borrowing money to trade plus access to Morningstar research reports, Nasdaq data, and bigger instant deposits. Itoffering them three months of service.

A month of Robinhood Gold costs $5 plus 5% yearly interest on borrowing above $1,000, charged daily. Before a pricing change, the flat fee per month could range as high as $200. However, compensated users will only get the $5 off per month, for a total of $15. That could seem woefully insufficient if Robinhood users missed out on buying back into stocks like Apple that went up over 9% on Monday. Robinhood is calling it a &first step&.

Impacted Robinhood users can contact the company here to ask for compensation. Below you can see the email Robinhood sent to custoemrs late last night.

Robinhoodemail to customers late last night

Robinhood is also working to contact impacted customers on a individual basis, and itlooking into other forms of compensation on a case by case basis, company spokesperson Jack Randall tells me. Itunclear if that might include cash to offset what traders might have lost by having their money locked in inaccessible Robinhood accounts during the outage.

Compensation could become a significant cost if the startup assesses that many of its 10 million users were impacted. The markets gained a record $1.1 trillion yesterday, but some Robinhood traders may not have been able to buy back in as the rebound occurred following mass selloffs due to fears of coronavirus.

Now the startup, valued at $7.6 billion, will have to try to regain users& trust. &When it comes to your money, we know how important it is for you to have answers. The outages you have experienced over the last two days are not acceptable and we want to share an update on the current situation . . . We worked as quickly as possible to restore service, but it took us a while. Too long& wrote co-founders and co-CEO Baiju Bhatt and Vlad Tenev [disclosure: who I know from college].

As for exactly what triggered the downtime, the founders write that &Multiple factors contributed to the unprecedented load that ultimately led to the outages. The factors included, among others, highly volatile and historic market conditions; record volume; and record account sign-ups.& Therebeen a frenzy of retail trading activity in the wake of coronavirus. Therealso been sudden spikes in stocks like Tesla amidst mainstream media attention.

Going forward, Robinhood promises to &work to improve the resilience of our infrastructure to meet the heightened load we have been experiencing. We&re simultaneously working to reduce the interdependencies in our overall infrastructure. We&re also investing in additional redundancies in our infrastructure.& However, they warn that &we may experience additional brief outages, but we&re now better positioned to more quickly resolve them.&

The outage comes at a vulnerable time for Robinhood as oldschool brokerages like Charles Schwab, Ameritrade, and Etrade all recently moved to eliminate per-trade fees to match Robinhoodpioneering zero-comission trades. Though some of those brokerages experienced infrastructure troubles recently, Robinhood massive outages could push users towards those incumbents that they might perceive as more stable.

- Details

- Category: Technology Today

Read more: Robinhood blames record trade volume itself for outages

Write comment (92 Comments)

After a network manager unexpectedly tightens up the rules for passwords and forces the expiration of all user passwords on the main application system, calls flood into the help desk, reports a pilot fish on the scene. They&re having trouble because of the new complexity rules.

One of the calls:

User: I can&t seem to change my password.

Help desk tech: Your new password needs to contain letters, numbers and punctuation. Do not use any words such as you&d find in a dictionary.

User: OK. (Pause.) No, it still won&t let me change it.

Tech: What is the password you are trying to use?

User: April.

Tech: &April& is a word.

To read this article in full, please click here

- Details

- Category: Technology Today

Read more: Memory-Lane Monday: The cruelest password

Write comment (93 Comments)We are still years away from a time when fully-autonomous cars will be able to drive us from A to B, and the complexity of getting to that point is likely going to need hundreds of billions of dollars of investment before it becomes a reality.

That hard truth is leading to some shifts in the self-driving startup landscape. EnglandFive (formerly known as FiveAI), one of the more ambitious companies in the space, is moving away from its original plan, of designing its own fully self-driving cars, and then running fleets of them in its own transportation service. Instead, it now plans to license its technology — starting with software to help test and measure the accuracy of a vehicledriving systems — that it has created to others building autonomous cars as well as the wider service ecosystem that will exist around that. As part of that pivot, today italso announcing a fresh $41 million in funding.

&A year and a bit ago we thought we would probably build the entire thing and take it to market as a whole system,& said co-founder and CEO Stan Boland in an interview. &But we gradually realised just how deep and complex that would be. It was probably through 2019 that we realised that the right thing to do is to focus in on the key pieces.&

The funding, a Series B, includes backing from Trustbridge Partners, insurance giant Direct Line Group and Sistema VC, as well as previous investors Lakestar, Amadeus Capital Partners, Kindred Capital and Notion Capital. The company has now raised $77 million and while itnot disclosing its valuation, Boland said that it was definitely up on its last round. (Its Series A, in 2017, was for $35 million, and it didn&t disclose valuation then, either.)

Fivechange in course is a significant development. The high-profile startup, founded by a team that had previously built and sold several chip companies to the likes of Broadcom, Nvidia and Huawei, had been the leading partner for a big government-backed pilot project, StreetWise, to test and work on autonomous driving systems across boroughs in London. The most recent phase of that project, running driver-assisted rides along a 19-km route across south London,got off the ground only last October after initially getting announced in 2018.

Five might continue to work on research projects like these, Boland said, but the primary business aim for the company will no longer be ultimately to build cars for themselves, but to work on tech that will be sold either to other carmakers, or those building services catering to the autonomous industry.

For example, Direct Line, one of Fivenew investors and also a participant in the StreetWise project, could use testing and measurement to determine risk and pricing for insurance packages for different vehicles.

&Autonomous and assisted driving technology is going to play a huge role in the future of cars,& said Gus Park, MD of Motor Insurance at Direct Line Group, in a statement. &We have worked closely with Five on the StreetWise project, and we share a common interest in solving the formidable challenges that will need to be addressed in bringing safe self-driving to market. Insurers will need to build the capability to measure and underwrite new types of risk. We will be collaborating with Fiveworld-class team of scientists, mathematicians and engineers to gain the insight needed to build safe, insurable solutions and bring the motoring revolution ever closer.& Park is also joining Fiveboard with this round.

There were already a number of big players in the self-driving space when FiveAI launched — they included the likes of Waymo, Cruise, Uber, Argo AI and many more — and you could have argued that the writing was already on the wall then for long-term consolidation in the industry. Indeed, there have been some significant casualties in the meantime, including Drive.AI (which Apple acquired after it ran out of money),Oryx Vision and Quanergy.

Five&sargument for why a UK — and indeed, European — startup was in a good place to build and operate self-driving cars, and the tech underpinning it, was because of the complexity behind building localised systems: a big US or Asian company might be able to map the streets in Europe, but it wouldn&t have as good of a feel for how people behaved on those roads. Added to that, Five firmly believed the economics of building and operating these cars would prove to be too high for wide-scale private ownership. Hence, the strategy (one adopted by many in the autonomous space) of building the technology for fleets, where transportation businesses, not individuals, would own the cars and recoup their investments by charging private individuals for rides.

Yet while it may have been easy to see the potential, the process of getting to that point proved to be too challenging.

&Whathappened in the last couple of years is that there has been an appreciation across the industry of just how wide and deep the challenges are for bringing self driving to market,& Boland said. &Many pieces of the jigsaw have to be assembled…. The B2C model needs billions [of investment], but others are finding their niche as great providers of technology needed to deliver the systems properly.&

As FiveAI (named after the &Level 5& that self-driving systems attain when they are truly autonomous), the company built (hacked) vehicles with dozens of sensors and through its tests managed to build a significant trove of vehicle technology.

&We could offer tech in a dozen different areas that are hard for autonomous driving companies,& Boland said. Its testing and measuring tools point to one of the toughest challenges among these: how to assure that the deep learning software a company is using is correctly identifying objects, people, weather, and other physical factors when it may have never seen them before.

&We have learned a lot about the types of errors that propagate from perception into planning… and now we can use that for providing absolute confidence& to those testing the systems, he said.

Self-driving cars are one of the biggest AI challenges of our time: not only is the requirement to essentially build from the ground up computer systems that behave as well as (or ideally better) than multitasking humans behind the wheel; but the consequence of doing that wrong is not just a strange string of words, or some other kind of non sequitur, but injury or death. No surprise that there appears still a very long way to go before we see anything like Level 5 systems in action, but in the meantime, investors are willing to continue placing their bets. Partly because of how advanced it got with its car project on relatively little funding, Five remains an interesting company to investors, and Boland hopes that this will help it with its next round down the road.

&We invest in category-leading companies that are delivering transformational change wherever they&re located,& said David Lin of Trustbridge Partners in a statement. &As Europeleading self-driving startup, Five is the furthest ahead in developing a clear understanding of the scientific challenges and novel solutions that move the needle for the whole industry. Five has successfully applied Europeoutstanding science and engineering base to create a world-class team with the energy and ambition to deliver safe self-driving. We are delighted to join them for this next phase of growth.&

- Details

- Category: Technology Today

As the U.S. braces for the coronavirus epidemic, businesses looking to protect the health of their employees are taking steps to support staff working from home & leading to a surge in demand for video conferencing technology and other collaboration tools.

The stock prices of Slack and video-conferencing software Zoom have risen in the past month, even as the overall stock market saw serious declines last week. Zoom has also gained a number of new users amid the outbreak, according to CNBC, with company officials saying they&ve seen more active users in the first two months of 2020 than in all of last year.

To read this article in full, please click here

- Details

- Category: Technology Today

Read more: As coronavirus worsens, companies renew focus on collaboration, remote work

Write comment (92 Comments)

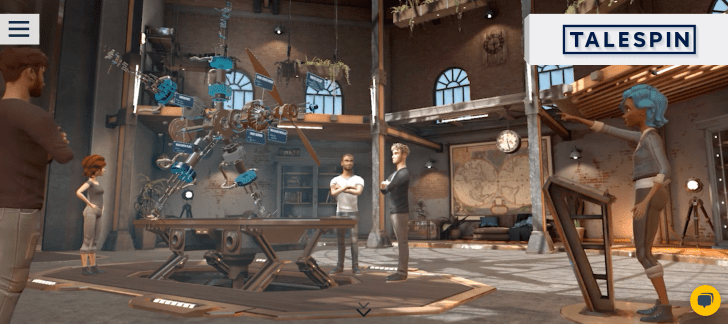

It turns out the virtual and augmented reality companies aren&t dead — as long as they focus on the enterprise. Thatwhat the Los Angeles-based extended reality technology developer Talespin did — and it just raised $15 million to grow its business.

Traditional venture capitalists may have made it rain on expensive Hollywood studios that were promising virtual reality would be the future of entertainment and social networking (given coronavirus fears, it may yet be), but Talespin and others like it are focused on much more mundane goals. Specifically, making talent management, training and hiring easier for employers in certain industries.

For Talespin, the areas that were the most promising were ones that aren&t obvious to a casual observer. Insurance and virtual reality are hardly synonymous, but Talespintraining tools have helped claims assessors do their jobs and helped train a new generation of insurance investigators in what to look for when they&re trying to determine how much their companies are going to pay out.

&Talespin‘s immersive platform has transformed employee learning and proven to be an impactful addition to our training programs. We&re honored to continue to support the Talespin team through this next phase of growth and development,& said Scott Lindquist, Chief Financial Officer at Farmers Insurance, in a statement.

Farmers is an investor in Talespin, as is the corporate training and talent management software provider Cornerstone OnDemand, and the hardware manufacturer HTC. The roundcomposition speaks to the emerging confidence of corporate investors and just how skeptical traditional venture firms have become of the prospects for virtual reality.

The prospects of augmented and virtual reality may be uncertain, but whatdefinite is the need for new tools and technologies to transfer knowledge and train up employees as skilled, experienced workers age out of the workforce — and the development of new skills becomes critically important as technology changes the workplace.

Cornerstone, which led the Talespin Series B round, will also be partnering with the company to develop human resources training tools in virtual reality.

&We share Talespinvision that the workforce needs innovative solutions to stay competitive, maximize opportunity and increase employee satisfaction,& said Jason Gold, Vice President of Finance, Corporate Development and Investor Relations at Cornerstone, in a statement. &We&ve been incredibly impressed with Talespintechnology, leadership team and vision to transform the workplace through XR. Talespintechnology is a perfect fit in our suite of products, and we look forward to working together to deliver great solutions for our customers.&

Talespin previously raised $5 million in financing. The company initially grew its business by developing a number of one-off projects for eventual customers as it determined a product strategy. Part of the companysuccess has relied in its ability to use game engine and animation instead of 360 degree video. That means assets can be reused multiple times and across different training modules.

&Creating better alignment between skills and opportunities is the key to solving the reskilling challenges organizations across the world are facing,& said Kyle Jackson, CEO and Co-Founder of Talespin, in a statement. &Thatwhy itcritical companies find a way to provide accelerated, continuous learning and create better skills data. By doing so, we will open up career pathways for individuals that are better aligned to their natural abilities and learned skills, and enable companies to implement a skills-based approach to talent development, assessment, and placement. Our new funding and partnership with Cornerstone will allow us to expand our product offerings to achieve these goals, and to continue building innovative solutions that redefine what work looks like in the future.&

- Details

- Category: Technology Today

Page 1338 of 1441

6

6