Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Weeks after Uber exited Indiafood delivery market, conceding defeat to local giants Swiggy and Zomato, a new player is gearing up to challenge the heavily-backed duopoly: Amazon.

The e-commerce giant plans to enter the Indian food delivery market in the coming weeks, a person familiar with the matter told TechCrunch. The launch of the service, which would be offered as part of either Amazon Prime Now or Amazon Fresh platform, could happen as soon as next month, we are told.

In the run up to the launch, the e-commerce giant has been testing its food delivery service with select restaurant partners in Bangalore, the source said, requesting anonymity as details of the new business are still private.

The company has been working on its food delivery business for several quarters and was previously aiming to launch it during the festival of Diwali. Itunclear what caused the delay.

TechCrunch could not ascertain the kind of business agreement Amazon has formed with Indian restaurant partners — many of which have grown frustrated with online food delivery players. An Amazon spokesperson was not immediately available for comment.

Amazonforay into the food delivery market would create new challenges for Prosus Ventures-backed Swiggy, and Zomato, a 10-year-old startup that acquired UberEats business in India for about $180 million in January.

Both the startups, having raised more than $2 billion together, are still not profitable, losing more than $15 million each month to acquire new customers and sustain existing ones.

Anand Lunia, a VC at India Quotient, said in a recent podcast that the food delivery firms have little choice but to keep subsidizing the cost of food items on their platform as otherwise most of their customers can&t afford them.

Figuring out a path to profitability is especially challenging in India as unlike in the developed markets such as the U.S., where the value of each delivery item is about $33; in India, a similar item carries the price tag of $4, according to estimates by Bangalore-based research firm RedSeer.

In recent years, both Swiggy and Zomato have expanded beyond food delivery businesses. Swiggy today runs what it claims to be the largest cloud kitchen network in India, and has also expanded to delivery of just about any item (not just food). Zomato has been working on &Project Kisan,& to procure raw material directly from farmers and fishermen in an attempt to assume control of the supply of items to restaurants.

Thatnot to say that it would be very easy for Amazon to scale its food delivery business in India. Swiggy alone operates in more than 520 cities in India and maintains partnership with over 160,000 partners.

Swiggy is adding 10,000 new partners to its platform each month, it said last week on the sidelines of its latest fundraise announcement. At stake is Indiafood delivery market that was worth $4.2 billion as of the end of last year, according to RedSeer.

Amazon has established a dense delivery network in India through its own logistics chain and also through partnership with thousands of neighborhood stores.

The companymove comes as Flipkart, its chief rival in India, is foraying into food retail business. Flipkart, which sold a majority stake in the company to Walmart for $16 billion last year, has registered an entity called &Flipkart Farmermart Pvt Ltd& that will focus on food retail, said Kalyan Krishnamurthy, Flipkart Group CEO, in a statement to TechCrunch in October.

The extended business for the Indian firm represents &an important part of our efforts to boost Indian agriculture as well as food processing industry in the country,& he said, adding that the company is already working with hundreds of thousands of small farmers for the business.Flipkart has already committed $258 million to the new venture. Last month, it piloted delivery of fresh fruits and vegetable, Indian newspaper Economic Times reported.

- Details

- Category: Technology Today

Read more: Amazon all set to enter India’s food delivery market

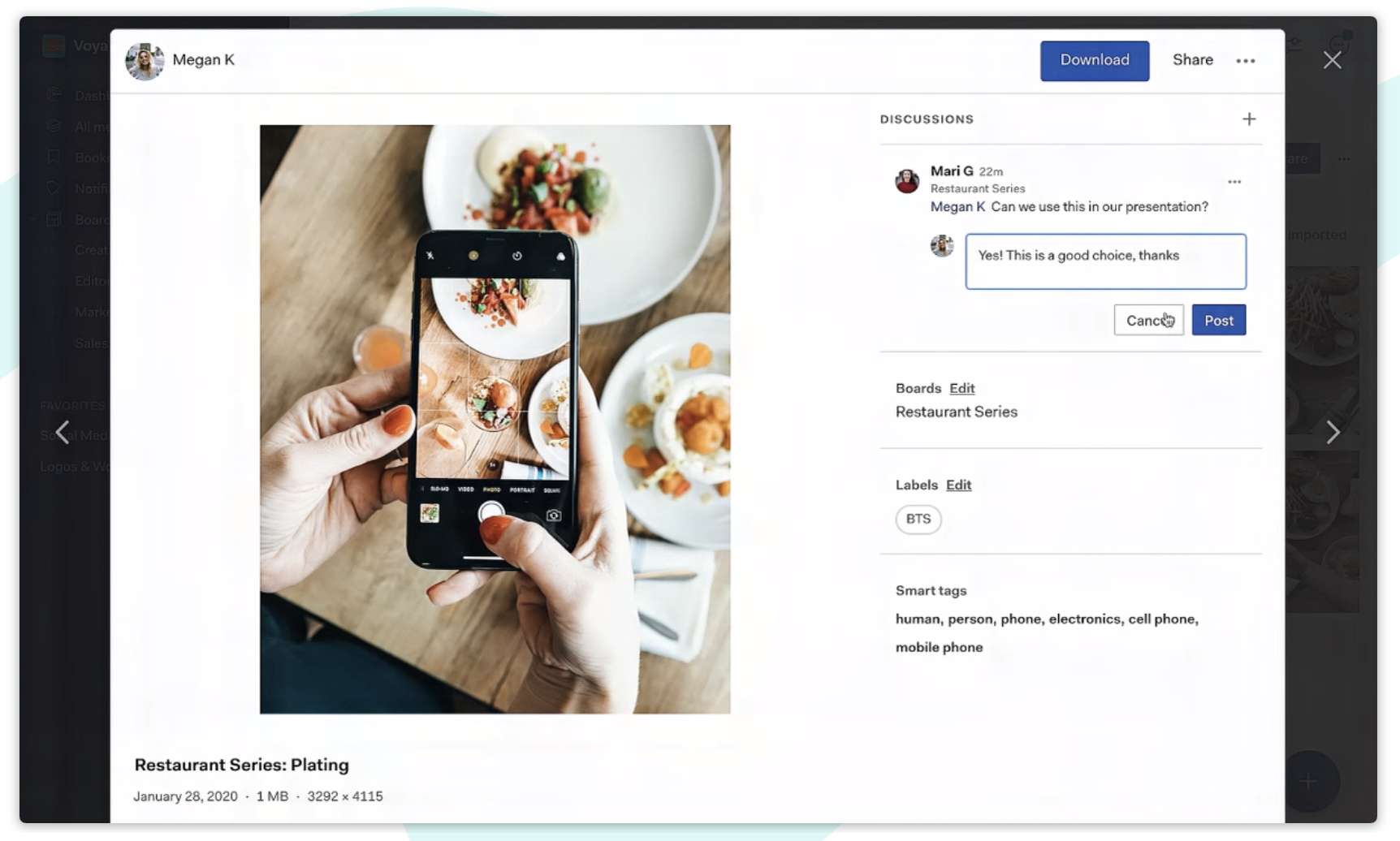

Write comment (93 Comments)When it comes to the so-called &consumerization of the enterprise,& a workplace tool that looks an awful lot like Pinterest seems like it would be the trendfinal form. Brooklyn-based Air is building a digital asset manager for communications teams that aren&t satisfied with more general cloud storage options and want something that can show off visual files with a bit more pizzazz.

The startup tells TechCrunch that they have closed $6 million in funding led by Lerer Hippeau . RedSea Ventures, Advancit Capital and WndrCo also participated.

General-purpose cloud storage options from Google or Dropbox don&t always handle digital assets well — especially when it comes to previewing items, and Airmore focused digital asset management competitors often require dedicated managers inside the org, the company says. Air has a pretty straightforward interface that looks more like a desktop site from Facebook or Pinterest, with a focus on thumbnails and video previews thatsimple and sleek.

Air is trying to capitalize on the trend toward greater à la carte software spend for teams looking to phase in products with very specific toolsets. The team is generally charging $10 per user per month, with 100GB of storage included.

&Adobe is an amazing suite of products, but with the idea that companies are mandating the tools that their employees use versus letting their employees choose — it makes a lot of sense that teams are going to ultimately end up having more autonomy and creating better work when they&re using tools that they care about,& Lerer Hippeau managing partner Ben Lerer tells TechCrunch.

Air lets customers migrate files from Dropbox or Google Drive to its AWS-hosted storage platform, which displays files like photos, videos, PDFs, fonts and other visual assets as Pinterest-esque boards. The app is a way to view and store files, but Airplatform play focuses pretty heavily on giving co-workers the ability to comment and tag assets. Collaborating around files is a pretty easy sell; a couple of users discussing which photo they like best for a particular marketing campaign doesn&t require too much imagination.

The team has been focusing largely on attracting users in roles like brand marketing managers, content coordinators and social media managers as a way of infiltrating and scaling vertically inside marketing departments.

&What Airtable did to spreadsheets and what Notion did to docs, we&re doing for visual work,& CEO Shane Hegde told TechCrunch in an interview. &As we think about how we differentiate, itreally that we&re a workspace collaboration tool, we&re not just cloud storage or digital asset management…&

- Details

- Category: Technology Today

Read more: Lerer Hippeau leads $6M investment in Pinterest-like digital asset manager Air

Write comment (99 Comments)

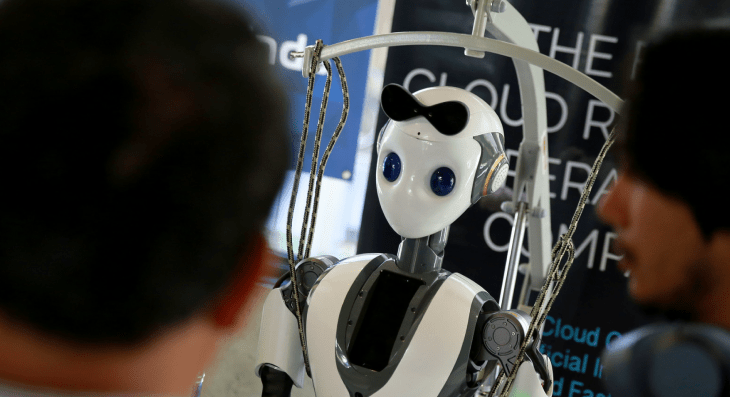

ItT-minus one week to the big day, March 3, when more than 1,000 startuppers will convene in Berkeley, Calif. for TC Sessions: Robotics + AI 2020. We&re talking a hefty cross-section representing big companies and exciting new startups. We&re talking some of the most innovative thinkers, makers, researchers, investors and influencers — all focused on creating the future of these two world-changing technologies.

Don&t miss out on this one-day conference of interviews, panel discussions, Q-As, workshops and demos dedicated to every aspect of robotics and AI. General admission tickets cost $345. Snag your ticket now and save, because prices go up at the door. Want to save even more? Save 15% when you buy four or more tickets. Are you a student? Grab a ticket for just $50.

What do we have planned for this TC Session? Herea small sample of the fab programming that awaits you, and be sure to check out the full TC Session agenda here.

- Q-A with Founders: This is your chance to ask questions of Sébastien Boyer, co-founder and CEO of FarmWise and Noah Ready-Campbell, founder and CEO of Built Robotics — some of the most successful robotics founders on our stage.

- Disney Robotics: Imagineers from Disney will present state-of-the-art robotics built to populate its theme parks.

- Investing in Robotics and AI: Lessons from the IndustryVCs: Dror Berman, founding partner at Innovation Endeavors, Jocelyn Goldfein, managing director at Zetta Venture Partners and Eric Migicovsky, general partner at Y Combinator will discuss the rising tide of venture capital funding in robotics and AI. The investors bring a combination of early-stage investing and corporate venture capital expertise, sharing a fondness for the wild world of robotics and AI investing.

And — new this year — don&t miss watching the finalists from our Pitch Night competition. Founders of these early-stage companies, hand-picked by TechCrunch editors, will take the stage and have just five minutes to present their wares.

With just one more week until TC Sessions: Robotics + AI 2020 kicks off, you don&t have much time left to save on tickets. Why pay more at the door? Buy your ticket now and join the best and brightest for a full day dedicated to all things robotics.

- Details

- Category: Technology Today

Read more: Grab your ticket: Only one week to TC Sessions: Robotics + AI 2020

Write comment (99 Comments)San Francisco-based startup Particle was one of the rising stars in the Internet of Things space, raising more than $81 million to date on the promise of helping to manage and secure the next generation of connected devices.

But the company is only now emerging from what its co-founder and chief executive Zach Supalla called a &turbulent period,& prompting layoffs and cost-cutting to help stay afloat, TechCrunch has learned.

Founded in 2012, Particle snagged $40 million in its Series C fundraise last October from big industrial investors, including Qualcomm Ventures and Energy Impact Partners, signaling strong support for the companymission. The startup pitches its flagship platform as an all-in-one solution to manage and secure IoT devices with encryption and security, but also scalability and data autonomy.

But a recent email sent by Supalla to his staff — obtained by TechCrunch — shows the company is course-correcting after a recent revenue miss.

The email, which the company confirmed was sent by the chief executive, said Particle laid off 14 staff members earlier this month, representing about 10% of the company. The layoffs of both engineering and support staff came just weeks after co-founder and chief technology officer Zachary Crockett quietly departed the company for &unrelated& reasons, said Supalla. (Crockett did not respond to a request for comment.)

According to Supallaemail to staff, Particlerevenue goal in 2019 was $16 million, but it ended the year with $10.3 million. Supalla cited, among other things, &operational challenges& with the business that he said kept the company &from executing as well as we could.&

Supalla said the company still has a &flush& bank account with more than $30 million in the bank, but the companycurrent burn rate of $2 million per month is &uncomfortably high.&

&We would only have until early 2021 to prepare for the next stage of financing the company,& he said.

The email added that the company is bringing on $10 million in venture debt, but Supalla told TechCrunch that the deal is &still in progress.& Particle is aiming to reduce its burn rate to about $1.6 million per month, which Supallaemail said would be achievable with the recent layoffs and reducing discretionary budgets, including marketing.

The cost-cutting will &put us in a position of financial strength,& the email said, adding that the company has &no intentions& of further layoffs.

Although the 14 employees have been given severance, one source said that some are still waiting for the payouts — some two weeks after the announcement — which Supalla confirmed in an email. TechCrunch also learned that former staff were asked to sign non-disclosure agreements. Supalla told TechCrunch that these agreements come with non-disparagement clauses, but that anyone laid off that wanted to be released from the non-disparagement terms would be.

Supallaemail is hardly the death knell for the company, but questions remain about its revenue targets and its efforts to reduce its monthly burn rate. The chief executiveemail said, candidly, that while layoffs can signal financial duress, they&re all too often made too late and &as a last resort.&

&Thatnot whathappening here,& said Supalla. &We have plenty of money in the bank and are making prudent cuts to strengthen the business.&

Got a tip? You can send tips securely over Signal and WhatsApp to +1 646-755&8849.

- Details

- Category: Technology Today

Read more: Particle lays off 10% of staff and co-founder departs after ‘turbulent period’

Write comment (91 Comments)As much as we&d all like to believe that our houses are built with perfectly square angles and other highly regular measurements, thatrarely the case — which makes remodeling complex and tedious. ShapeMeasure hopes to alleviate that pain with a device that automatically measures a space and a robotic mill that cuts the required lumber precisely to size, shortening and easing the process by huge amounts.

Founder Ben Blumer, who was exposed to the art of building and repair early by his father, a general contractor, had a brainwave that became the company during some renovations of his own.

&I was shocked to see our flooring installer, who had 10 years of experience, and was excellent at what he did, take over an hour to install a single stair,& Blumer said. &I started thinking, ‘a little bit of technology could go a long way here.& &

Finding himself at the time free to work on such a project, he recruited a former general contractor friend and applied to HAX, which soon shipped them off to Shenzhen to pursue their idea.

The main issue is stairs: they&re tricky, and especially in older homes can be pretty off-kilter. So although you know each stair is about 35 inches wide, it might be 35 and 3/64 inches, while the next one could be 34 and 61/64. Likewise, the angles might be ever so slightly off the 90 degrees or whatever they theoretically should be. Painstakingly measuring every single stair and manually cutting wood to those many slightly different dimensions is extremely time-consuming. The tool ShapeMeasure built makes it literally a push-button affair.

The device they settled on is essentially a super-precise lidar that measures around itself in wide arc, and the exact details of which comprise part of the companysecret sauce. This gives the precise dimensions and attachment angles of the area around it, in the first intended use case a stair. The design, helped along by HAXNoel Joyce, looks a bit like a giant Dust Buster by way of the original &Alien.&

Obviously his shirt contradicts my headline, but if you think about the cutting as an automated process rather than something a person has to do, mine makes sense.

&We were working with Noel Joyce, HAXlead industrial designer. We wanted a product that looked and felt like a tool. We figured, if you&re trying to convince contractors to try something new, it should feel familiar,& Blumer said. &We spent hundreds of hours sourcing parts and re-engineering our scanning mechanism so that it could fit into Noelbeautiful form factor. Turns out, contractors don&t care what it looks like. They liked the design, but were way more excited for the functionality.&

Once the shapes are scanned in and checked, that information can be beamed off to ShapeMeasureother device, a robotic lumber sizing system that cuts wood into the exact size and shape necessary to fit together as stairs. Of course, the contractor still has to bring them to the location and attach them by whatever means they see fit, but what was once a process with perhaps hundreds of steps has been simplified by an order of magnitude.

The machine is similar to other lumber-cutting devices, but simpler and easier to operate.

&There are lots of automatic cutting systems — often big, heavy, expensive and operated by professional CNC technicians. To cut flooring on a machine like that involves setting up jigs, clamping and reclamping each board, and generating custom gcode for each stair we cut,& Blumer said. They can be several times more costly and difficult to employ. &The cutting solution we&re building is compact, requires no clamping, and can be operated with just a few hours of training.&

Itnot just about length and width, either — molding and other flourishes on the stairs can make complex cuts necessary that would be impractical or at the very least extremely time-consuming to attempt manually.

Examples of complex cuts made by the ShapeMeasure machine.

The result is that the installation process from start to finish is about four times faster, they determined. If this seems a bit optimistic, know that it isn&t just armchair theorizing — they were careful to back up these numbers from the start.

&We take our speedup data really seriously,& said Blumer. &This is our top metric! One of the first purchases I made for the company was a dozen stopwatches. We&ve done installations in the ShapeMeasure lab and on real, messy construction sites — filming, timing and logging every moment.&

Interestingly, the precut lumber made other improvements possible — the team designed a bucket to accommodate the increased rate at which the installer uses glue and other parts. Ita bit like if you improved painting speed so much that your new bottleneck was mixing and pouring the paint into roller trays fast enough.

Currently the company is working on establishing standard practices and packaging so that a ShapeMeasure µfactory& can be set up easily anywhere in the country on short notice. And they&re &considering& raising money before then to accelerate the process. Blumer built the prototype with his own money and they pulled in a bit from HAX and then a small pre-seed round to get things started.

With luck and a bit of elbow grease, ShapeMeasure could turn out to be a real differentiator in the contractor space — every hour counts, as does every dollar in an estimate.

- Details

- Category: Technology Today

Read more: ShapeMeasure’s smart tool and robotic cutter let contractors measure once and cut never

Write comment (93 Comments)Eagle-eyed readers will recall that we mentioned M1 Finance earlier today in our look at a few trends in the fintech industry. We&re back with the firm this afternoon as it has a bit of news thatworth discussing.

Chicago-based M1 Finance announced today that it has reached the $1 billion assets under management mark, or AUM. Reaching AUM thresholds provides useful milestones that we can use to track the progress of various players in the fintech and finservices worlds.

M1 is an interesting company, bringing together a number of products to form a single platform. Its hybrid nature makes comparing its AUM to other companies& histories a bit dicey. Still, for reference, Wealthfront, a roboadvisor, announced that it started 2013 with AUM of $100 million, and closed that year with $538 million. By mid-2014, Wealthfront had $1 billion AUM. Today it has over $20 billion.

So, the numbers matter, and reaching thresholds can help us understand where a company is in its maturity cycle.

Lettalk about M1 Finance AUM growth, its revenue growth and its product model. Ita neat company with a history of efficient growth.

Growth, product

We&ll start with product, as how the company approaches its feature-set helps explain how the service is priced, which in turn helps us grok the companygrowth.

M1 is not a roboadvisor, or a simple neobank, or a lending product; itall three at once, providing effectively the digital equivalent of a full-service bank, admittedly in the form of an online experience instead of a brick-and-mortar outlet. M1 users can open investment accounts, checking accounts, get a debit card and borrow money against their investment portfolios; ita cohesive feature set.

And one that lets M1 price its products lower as a group than it could individually. During a call with M1CEO Brian Barnes about the companyAUM milestone, the executive connected the companylong-term vision to its ability to price aggressively. (All fintechs are expanding their platforms, itworth noting, meaning that, in time, nearly every fintech player will offer an array of services; Wealthfront, famous for its work in roboadvising, now also offers savings and borrowing capabilities.)

Barnes said that M1 has long wanted to &manage the bulk of [its users&] financial assets, not create a sort of low-friction acquisition hook& to bring in smaller-dollar accounts. This, in turn, means that M1 can have higher per-user sums on its books, which, it appears, helped the company reduce prices on a per-product basis.

HereBarnes connecting per-account totals to pricing:

Managing more of someonefinancial assets, and financial life, is going to be more economical. What it allows us to do is maintain lower margins per product, but have enough margin on the entire financial relationship that we can build a very sustainable durable, long-lasting business.

Thatneat! And folks with lots of money expect low fees, especially in the Robinhood-era, so the setup probably helps with attracting users.

Revenue

Summing so far, M1 runs a broad set of financial products, attracting more dollars-per-user than other companies, perhaps, which lets it charge, in its view, lower prices.

How low? Barnes told TechCrunch that his company is &building [its] business model to make 1% of assets we manage [into] top line. So every billion bucks on the platform will be 10 million dollars in recurring revenue. And it is a relatively linear relationship.& The CEO later extended the point, saying that when his firm has $10 billion in AUM, it will generate $100 million.

This means that as M1 scales, we&ll be able to know with reasonable confidence how much revenue itdriving.

The company charges in the manner you&d expect, with incomes from loaning money, interchange and a SaaS-product called M1 Plus that lowers some fees and provides interest on checking accounts, costing $125 yearly.

Now that M1 is big enough to matter, it has to double, and then double again. We&ll know how well thatgoing based on how quickly the company reaches the $2 billion mark.

- Details

- Category: Technology Today

Read more: Chicago’s M1 Finance, a consumer-focused fintech platform, reaches $1B under management

Write comment (90 Comments)Page 1381 of 1439

19

19